CYBG BEATS TARGET IN SECOND YEAR OF SME LENDING COMMITMENT

13th May 2019, 10:22 am

CYBG beats target in second year of SME lending commitment

- CYBG – owner of Clydesdale and Yorkshire Banks – lent over £2 billion to SMEs in 2018

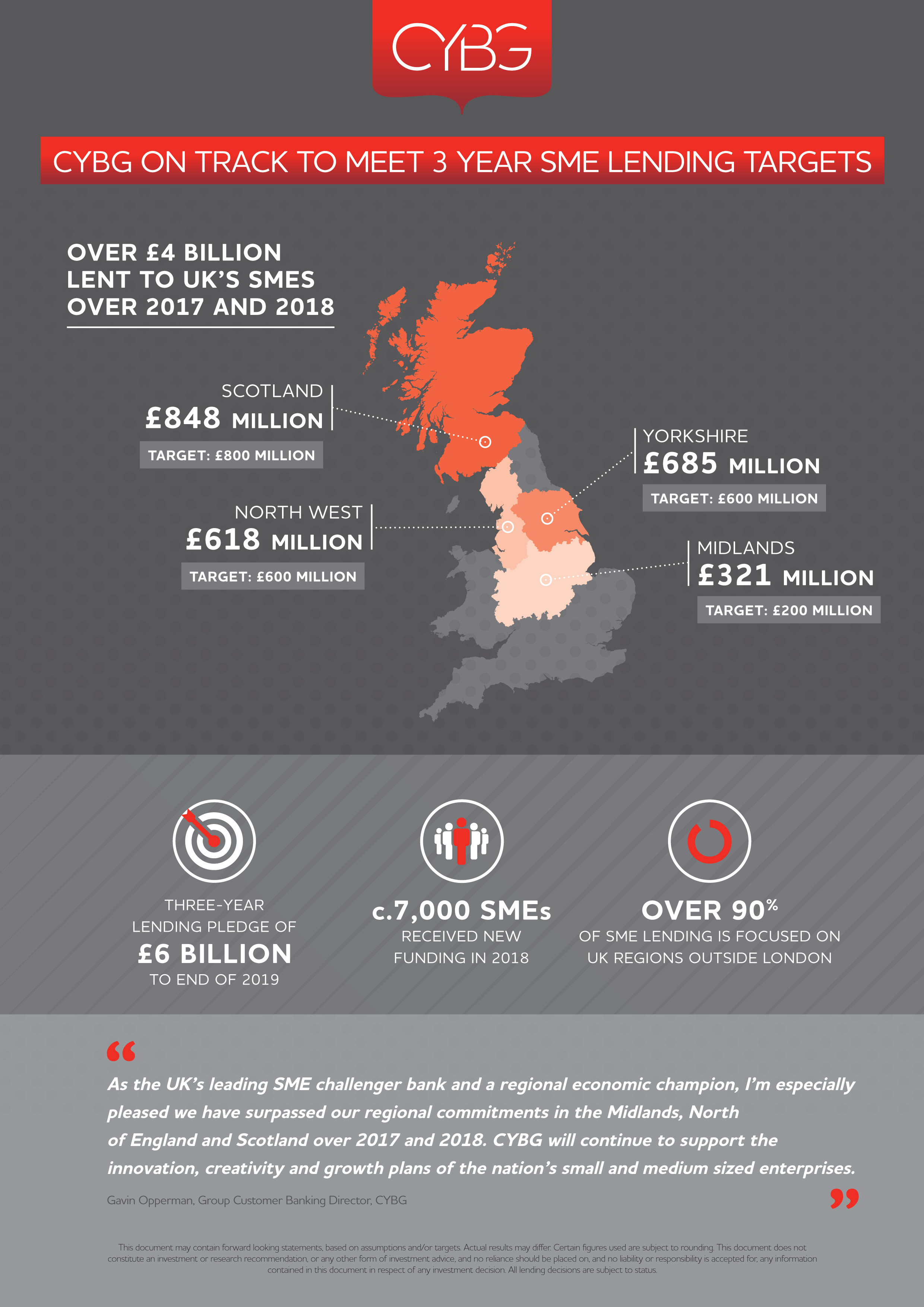

- With over £4 billion lent in the last two years, the Bank is well on track to meet its £6 billion lending pledge over three years to end December 2019.

- CYBG remains on track to meet its lending commitments even though the Bank’s latest SME Health Check Index showed that SME business confidence dropped to the lowest level since the Index began tracking in 2014.

CYBG PLC, owner of Clydesdale and Yorkshire Bank, announces that in 2018 it provided over £2 billion in lending support to the UK’s small and medium sized businesses (SMEs). This takes total lending to £4.05 billion in the first two years of its three-year commitment to help fuel SME growth by lending small firms £6 billion, putting it well on track to meet the target by the end of 2019.

The Bank lent money to c. 7,000 SME businesses across the UK’s regions, with over 90% of SME lending focused on regions outside of London. The Bank’s lending commitments have been met or exceeded in all of the UK’s regions against combined targets set for 2017 and 2018:

- Funding in the Midlands increased to over £180 million, 80% above the Bank’s £100 million commitment for 2018 and making a two-year total of £321 million, against a target of £200 million.

- In Scotland, a total of £382 million was lent, making a two-year total of £848 million against a target of £800 million.

- In Yorkshire, £380 million of funding was provided to SMEs, beating the target of £300 million by 27%. The two-year lending total is £685 million against a target of £600 million.

- In the North West, lending in 2018 of £318 million was ahead of our £300 million target, with a two-year total of £618 million against a target of £600 million.

CYBG’s latest SME Health Check Index, released earlier this month pointed to grounds for optimism amongst UK SMEs, with the health of SMEs increasing by almost five points. This rise was driven by an increase in borrowing, with lending reaching its highest level since tracking of the Index began in 2014. There was also strong employment growth and positive net business formation, however decelerating GDP growth, partly driven by a slowdown in the global economy and increased household borrowing, fed into decreased SME confidence.

Commenting on the successful lending, Gavin Opperman, Group Customer Banking Director at CYBG, said:

“I’m delighted we have exceeded the first two years of our commitment to lend SMEs £6 billion across the UK over three years, with a further £2 billion provided in 2018. As the UK’s leading SME challenger bank and a regional economic champion, I’m especially pleased we have surpassed our regional commitments in the Midlands, North of England and Scotland over 2017 and 2018. CYBG will continue to support the innovation, creativity and growth plans of the nation’s small and medium sized enterprises.”

Next Article

Rochdale is open for business, hosted by Chris Maguire