Getting Started With ESG Reporting: A Guide For SMEs

25th June 2025, 1:36 pm

With sustainability now a global priority, SMEs are under increasing pressure to understand and communicate their environmental, social, and governance (ESG) impacts. As SMEs account for 99.8% of the business population in the UK (5.5 million businesses), their role in driving change is crucial.

Why ESG Reporting Matters for SMEs

ESG reporting, once focused on large corporations, is now relevant to SMEs as stakeholders expect greater transparency. Investors, banks, and customers want to see clear sustainability data.

The Role of ESG Reporting in Transparency and Accountability

Reporting helps SMEs build trust, access funding, improve operations, and strengthen relationships through measurable, credible sustainability efforts.

For SMEs, this transparency can:

- Help build stronger relationships with investors, partners, and customers

- Support access to finance and procurement opportunities

- Strengthen brand reputation and employee engagement

- Drive internal improvements by identifying risks and areas for innovation

But, how can I get started?

The best place to start is with a materiality assessment. This helps your business identify and prioritise the ESG topics that matter most – both to your stakeholders and your operations.

A materiality assessment helps SMEs direct their limited resources toward areas that truly matter. Rather than trying to action everything, businesses can focus on what’s most relevant to their impact, strategy, and stakeholders. It also encourages a more holistic view of the business, identifying potential risks and opportunities across the entire value chain.

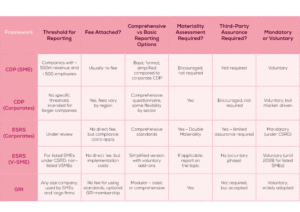

Which framework is right for me?

ESG frameworks are constantly evolving, with frequent updates, modifications, and new guidance on methodologies and reporting requirements. There’s a significant level of interoperability between frameworks, for example, the ESRS requirements are based on the GRI.

While mandatory reporting remains a complex and shifting area due to ongoing changes in EU regulation, voluntary reporting is a smart place to start. It gives companies a valuable head start in aligning with future mandatory requirements, particularly if they come into scope down the line.

What is the business case for ESG Reporting?

SMEs with strong ESG practices are increasingly favoured by banks and investors. Demonstrating sustainability can improve access to ethical investment, green finance, and grant funding, while also leading to lower borrowing costs, freeing up cash to reinvest in growth.

By embedding ESG into day-to-day operations, SMEs can reduce exposure to risks such as extreme weather, supply chain disruptions, or shifting regulations. This proactive approach strengthens business resilience and protects against potential reputational or financial damage.

New ESG regulations are beginning to affect smaller businesses, particularly those supplying to larger companies subject to mandatory reporting. Preparing early helps SMEs stay ahead of compliance requirements and positions them as reliable, forward-thinking partners.

Large corporates and government buyers are now prioritising ESG when selecting suppliers. Demonstrating strong sustainability credentials can give SMEs a competitive edge when bidding for contracts, especially in public sector procurement, which is worth over £300 billion annually in the UK.

Finally, ESG is a catalyst for innovation and growth. It encourages new ideas, from energy-saving operations to sustainable products, and aligns with shifting consumer expectations. As more customers favour businesses that take sustainability seriously, SMEs can build loyalty, attract new markets, and differentiate themselves in a crowded marketplace.

Conclusion: Why ESG Matters for SMEs

ESG is no longer just for big corporations. It is a growing priority for SMEs navigating today’s evolving business landscape. With increasing regulatory pressure, rising customer expectations, and a stronger focus on responsible supply chains, ESG reporting is becoming essential for long-term success. SMEs that embrace ESG are better equipped to manage risks, win contracts, attract funding, and stand out in competitive markets.

At Positive Planet, we make ESG reporting clear and achievable for SMEs. From compliance to strategy, our tailored support helps you meet expectations, unlock new opportunities, and build a more resilient, sustainable business.

For more information on what we do here at Positive Planet, and for bespoke support, contact us.

For further information on ESG Reporting, download our free resource.

Mid-Market can be an engine of growth for the North West economy